Days Sales Outstanding (DSO)

Days sales outstanding is a measure of how effective an organization is at getting paid. DSO indicates how many days of sales are still left uncollected.

Obviously, an excessively high number means a lot of cash is tied up in the cost of producing and shipping products. On the surface, it might seem that the lower this number is, the better. It is true to a degree, but at some point, overly restrictive credit policies and aggressive collections will alienate customers and cost sales.

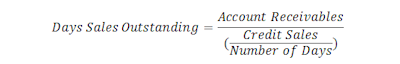

The basic formula for DSO is:

The denominator of this equation is determined by dividing the credit sales in a period by the number of days in that period. That yields the average sales.

Keep in mind that this is the basic, vanilla version of the calculation. Your finance team may have its own version that is used for internal analysis.

Why Measure Days Sales Outstanding?

DSO matters to an organization because it represents working capital that is tied up. Essentially, the company has loaned money to its customers to purchase products. This is OK if the company wants to loan money to its customers. Some companies offer financing to help boost sales.

The problem with having a large amount of receivables outstanding comes when the company prefers not to have that much cash tied up, or is just bad at collecting on time.

Getting paid faster provides money to help spur growth or expand the business. Having money tied up in undesired customer loans forces the company to either limit their own investment or find other sources of money to grow. It doesn’t make sense to pay to borrow money while lending money to customers for free.

DSO and Continuous Improvement

The truth is that having a high DSO is often unavoidable. The company may only be able to land sales by giving generous terms, or they may worry about alienating customers with aggressive collection tactics. Fortunately, reducing DSO can be done with fairly standard continuous improvement efforts.

First off, the better your service, delivery, quality, customer service, and products are, the more clout you have in the relationship. But assuming those projects are progressing slower than needed to budge your DSO total, you still have other options.

Pareto charts can be used to see if particular types of customers pay later, or if certain product groups are linked to late payments. Flow charts can help identify areas where changes can be implemented to speed up payments. Documentation and standardization provide a baseline upon which to improve processes, and also acts to spur best practice sharing.

Most importantly for improvement, though, the drivers for excessive DSO should be identified and tracked at the frontline. These driver metrics might be the percent of reminder (collection) calls made at the correct time, number of calls per hour, effectiveness of calls, or the quality of credit checks. The point is that you should identify a measurable process that is linked to overall success, and then measure that process.

Having the process metrics identified and tracked opens the door for improvement opportunities. DSO is a lagging indicator. It tells you how well you have done, not how well you are doing. Find the drivers and track them real time.

Words of Warning for DSO

- Don’t make decisions solely based on the effect it will have on DSO. For example, should a huge order be turned down because a customer demands better payment terms? Perhaps they want 60-day payments terms rather than 30? Should credit card payments be pushed if customers do not want to use that method? Being overly restrictive can cost business.

- DSO as a metric can create a rift between departments. If finance is tasked with reducing DSO, their actions may make it harder for sales to land clients. Think through how metrics interact and make sure they are compatible. Effective policy deployment helps highlight potential problems.

0 Comments